Information for:

- Masters

- Postgrad courses

- Courses

- Faculty and research

- About UPF-BSM

Rate rise: so will mortgage payments be affected

22 Febrero - 2022

Pablo Larraga López

Lecturer at Master in Finance and Banking

__

In Spain for many decades most mortgages were contracted at a variable rate. At the end of 2021 this situation is even, 50.2% of mortgages were variable rate and 49.8% fixed rate, a phenomenon that has developed mainly in the period 2016-2021 due to the attractiveness of fixed interest rates in very low magnitudes.

Whoever has a fixed-rate mortgage will pay a constant monthly fee from start to finish. On the other hand, whoever contracted a variable rate mortgage will see the monthly installment to be paid modified, each time it is recalculated and renewed on an annual basis.

Despite the existence of 15 official interest rates published by the Bank of Spain, variable-rate mortgages take as an almost exclusive reference the 1-year Euribor, the second most used index being the renewed IRPH as a whole of Spain, while the rest of the indices are not usually used.

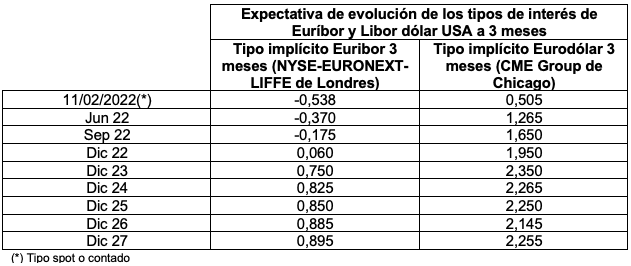

Tables are then shown that summarize the expectations of interest rate increases for 2022 and subsequent years, stating that they are not personal opinions based on expectations of news or analysis of banking or university research services, but objective figures extracted from the current interest rate curves that implicitly determine prices in derivative products such as futures contracts and swaps, where the prices of such contracts show estimates of market operators, not based on theoretical figures, but on real transactions and assuming highly parallel shifts in the interest rate curve.

One deduction that can be drawn from the figures set out in Table 1 is that markets are pricing in a rise in interest rates of a certain intensity over the next two years and then stabilising. As usual, interest rates on the dollar can rise more quickly and intensively, as a result of the Federal Reserve could raise federal funds intervention interest rates by 150 basis points in 2022 and by another 25-50 basis points in 2023, figures that are usually rounded to 25 basis points.

On the other hand, the expectations corresponding to the interventions of the Central Bank, can take the rates of the Main Intervention Operations to 7 days from 0% to 0.50% in 2022 in several gradual increases throughout the year and to increases between 75 and 100 additional basis points in the period 2023-24.

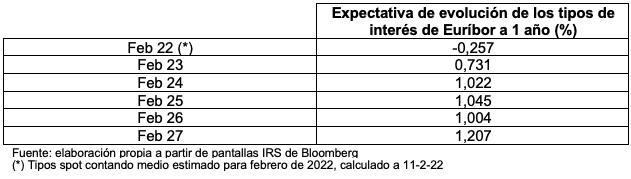

Table 2 analyzes the expectation of 1-year interest rates for the Euribor where figures obtained from the calculation of implicit rates of the Swaps on interest rates (IRS) at a fixed rate between 1 and 6 years on the variable rate of the Euribor to 1 year appear. Se appreciates the expectation of an increase in interest rates for 2022, with a continuation of the increase in the period 2023-2025, a slight decline in 2026 and a new increase in 2027. In short, it is estimated a rise of approximately 100 basis points in 1 year of just over 30 basis points in the period 2023-25.

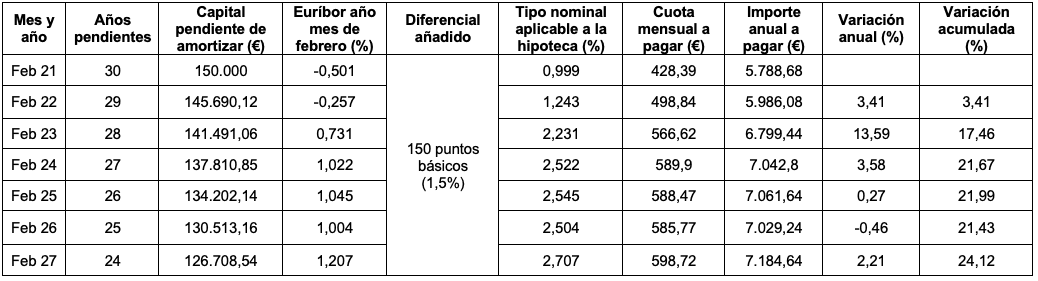

Finally, Table 3 shows the consequences of these estimated interest rate increases and is done through the following relatively standard mortgage loan simulation:

- Variable rate mortgage granted in May 2021.

- Interest rate reference: Euribor 1 year with 3 months of lag (February).

- Differential applied: 150 basis points.

- Calculation of quotas by French system.

- Loan amount: 150.000 euros.

- Term 30 years and monthly payments.

In Table 3, the expectation of an interest rate hike between February 2021 and February 2027 is 170.8 basis points, a figure that cannot be considered exorbitant given that the European Central Bank has had a neutral or reference interest rate of 2%. Despite the fact that the increase in interest rates in percentage is 341% making a simplistic and mathematically crude calculation, the mortgage installments may rise by 3.41% in the first renewal of May 2022, 13.59% in the period May 2022-23 and in the studied period of 6 years, it is observed that the installments could increase by 24.12%.

By way of summary or conclusion, it is convenient that mortgaged lenders assume that the amount they have been paying so far in their variable-rate mortgage loan will be modified upwards more or less immediately and also in the medium term. Depending on the evolution of the disposable income of families, either with reduction, maintenance or improvement of work activity or with unemployment of one or more of the members of family units, the rise will be more bearable or more traumatic.